Starting a business is an exciting moment in life. Expanding a business is too, because it means your initial idea is paying off. But one of the biggest hurdles to both is money — having the capital to launch or expand. The good news is, with a little digging, you can find small business grants and loan opportunities.

You just need a little help knowing where to look. And for that, you’ve come to the right place.

What are small business grants and loans?

A small business grant is essentially free money. It means you don’t have to pay it back, ever. However, most grants come with stipulations and restrictions regarding who can win the grant, and how the money will be used. They also usually have a cumbersome application process, and the IRS generally considers a grant to be business income, which means that it’s taxable.

A small business loan, or financing, is money given to you that you must eventually pay back, just like a house or car loan. Some small business loans charge interest, while others charge a flat fee.

Types of small business loans

Essentially, there are three types of small business financing:

- Debt financing means an institution gives you money and you have to pay it back, usually with interest on a set schedule. Sometimes they also want a form of collateral so if you default on the loan, they seize the asset you assigned to it.

- Equity financing is when another partner or business entity gives you a loan in exchange for partial ownership of the business. Usually you’ll pay them a percentage of your revenue going forward, and you lose some autonomy because you now have a business partner. But the loan is typically interest-free.

- Revenue-based financing is when you get a loan, but you pay it back as a share of your revenue, not a fixed monthly payment. We’ll say more about this later when we talk about WooCommerce Payments + Stripe Capital and Wayflyer.

But within those categories, you can find some variations. Most loans come from banks, but some can be given through the government, and others from specialized private businesses.

Fundera offers a terrific resource for learning all about small business financing. They even list specific banks and the credit scores they require. Some banks and lenders offer loans for certain situations that may be relevant to you. You can find out more about each of these financing options at Fundera:

- Equipment financing: a loan that pays for a piece of equipment

- Short-term business loan: an option for quick turnaround and urgent needs

- Merchant cash advance: a variation of revenue-based financing

- Startup loans: financing given specifically for new businesses

- Business line of credit: a flexible loan that makes money available as you need it

- SBA loans: financing from the Small Business Administration, including microloans

Factors to consider when pursuing small business financing

The three main factors you want to think about before applying or accepting an offer for a small business loan are ownership, control, and risk.

With equity-based loans, for example, you give up some amount of ownership in your business, and you lose some control over the decision-making. But, these loans usually have no interest, so they’re low risk.

A typical debt-based business loan with monthly interest payments comes with more risk, because what happens if you can’t make the payments? But, it lets you retain ownership. See more information about the pros and cons of different small business financing options.

A loan for existing small businesses: introducing WooCommerce + Stripe Capital

Access to financing can fortify and fuel your growing business, helping you expand and scale more quickly. With fast, flexible financing, WooCommerce + Stripe Capital enables U.S.-based companies to invest in growth and stabilize cash flow.

With WooCommerce and Stripe, loan offers are extended by Stripe’s banking partner, Celtic Bank, based on factors such as your store’s sales and history with WooCommerce Payments. There’s no lengthy application process and no consumer credit check.

Once you receive an offer via email or in your dashboard messages, you can select the size that’s right for you and apply in minutes. For approved companies, funds typically arrive in as little as one business day.

Unlike many loans offered through traditional banks, WooCommerce + Stripe Capital charges one fixed fee, and that fee never changes. That means there are no interest charges or late fees for you to worry about. Repayment also happens automatically, through a fixed percentage of your transactions, and adjusts to your daily sales. A fixed percentage will continue to be deducted until the total owed is repaid.

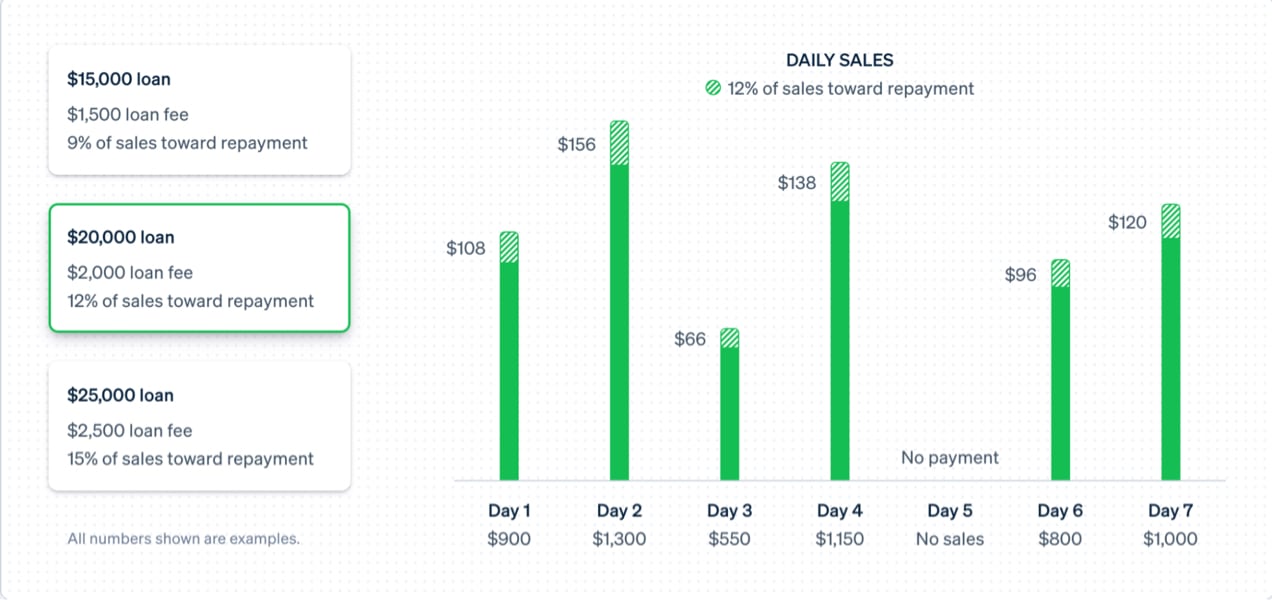

For example, suppose you get a $20,000 loan from Stripe Capital, and they offer you a 10% fee. That means your total loan debt is $22,000 which is a loan amount of $20,000 and a loan fee of $2,000.

In our example, Stripe Capital has established a payback rate of 12%. This means that every day, Stripe Capital will automatically deduct 12% of revenue from your WooCommerce account for that month until the loan is paid off. This is advantageous to you because it means your payment will rise and fall based on your revenue, so your payments will never exceed your income. If you make no revenue in a given month, there’s no payment.

Suppose one day you make $900 in revenue, and the next day you make $1,300. Your payment on the first day (assuming a 12% payment) would be $108, and on the second day, it would be $156.

Learn more about WooCommerce + Stripe Capital.

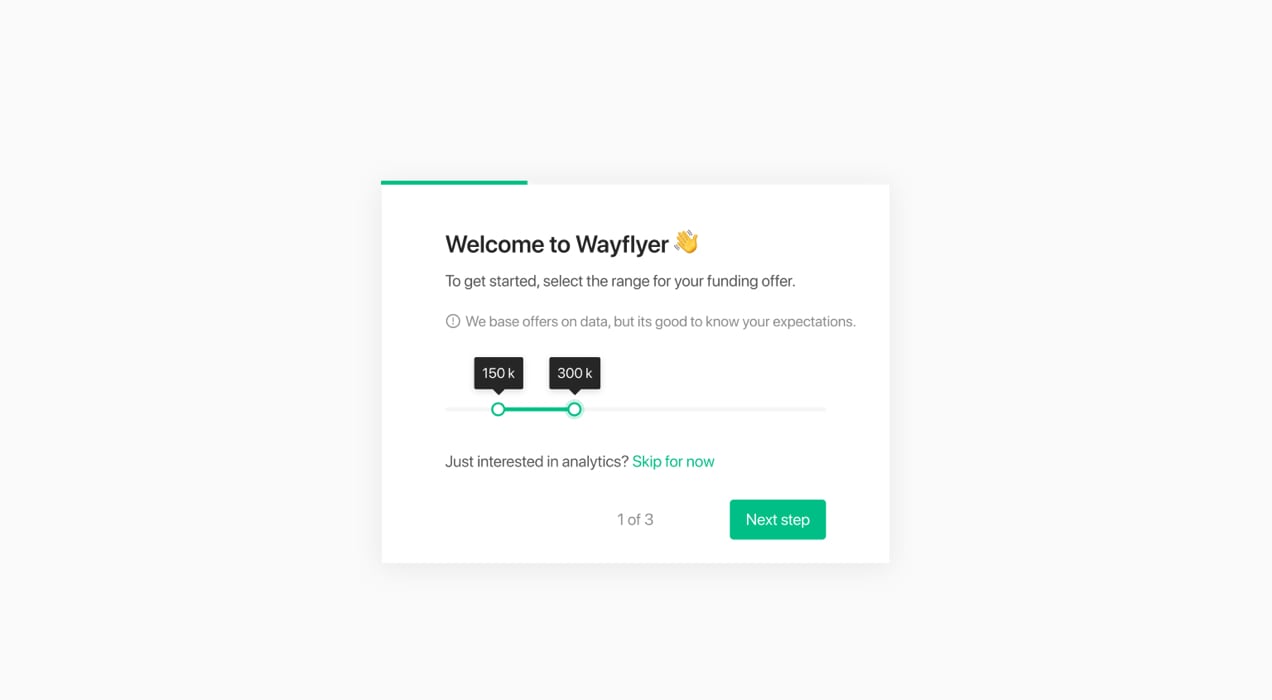

Another low-risk eCommerce business financing option: Wayflyer

Wayflyer offers no-interest, revenue-based loans specifically to eCommerce businesses for inventory and marketing expenses.

Instead of interest, Wayflyer charges a fixed fee. And because it’s a revenue-based loan, you have little risk of going into default, because revenue-based loans adjust the payment each month based on how much income your business generates.

Isn’t it great how revenue-based financing works? It would feel more or less like a sales tax, except in this case, once the loan is paid off, the payments end. Learn more about Wayflyer’s model and read their FAQs.

Types of small business grants

Unlike loans, which are fairly simple to understand, grants can be difficult to locate and navigate through all the requirements and restrictions.

In general, there are two types of grants: government grants and private grants. Private grants usually come from businesses or foundations.

There are grants for all kinds of very specific situations and business types, including:

- Awards for contest winners

- Scientific research companies

- Businesses owned by women, minorities, or veterans

- Agricultural and rural businesses

- Beauty and health businesses

- And many more…

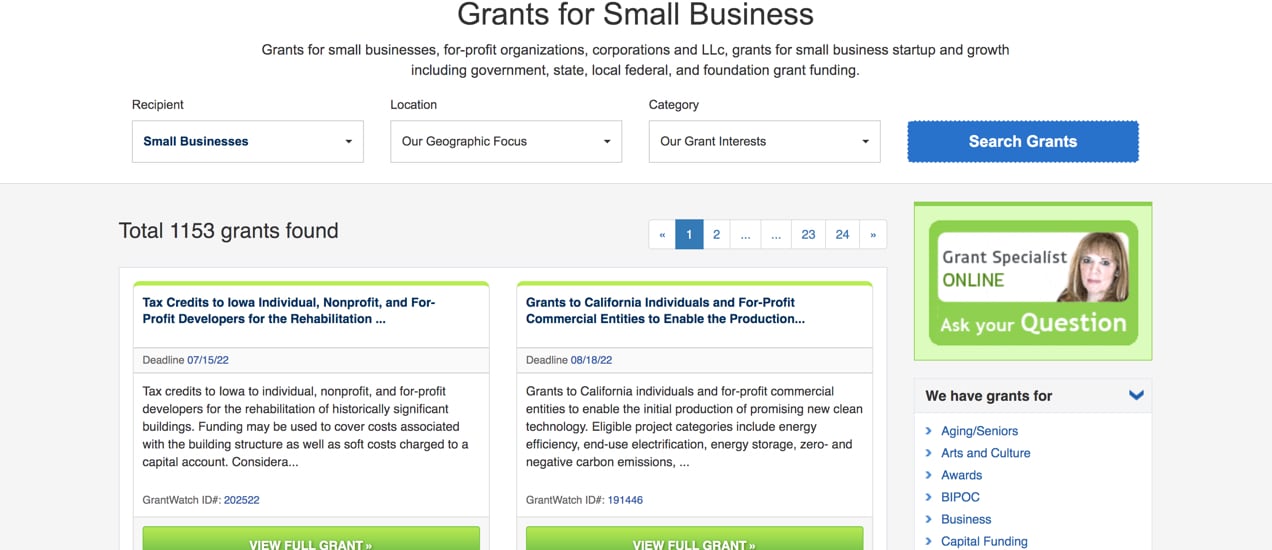

So when you go to a site like Grantwatch, which charges a fee if you want all the details of a grant, you’ll see thousands of options, updated frequently. But before your mouth starts watering, remember that you won’t qualify for many of those grants, because they can be for very specific situations like those listed above.

We’ll show you some resources for more grants in a bit.

Applying for small business grants

Before you apply for a small business grant, the first task is to narrow down your search around grants that your business actually qualifies for. There’s no use filling out a long application for a small business grant you have no chance of winning because you don’t meet the requirements.

For example, if you’re part of a minority group, you’ll be able to apply for a number of minority small business grants. You’ll have a better shot at those than the general grants, because there will be less competition, and because those grants were created specifically for businesses like yours.

Next, even for existing businesses, you’re going to want to have a well-written business plan, because most grant applications ask very specific questions.

They want to know why you need this grant.

They want to know their money is funding a worthwhile business venture or expansion with strong potential and that meets their reasons for offering the grant. If you haven’t updated your business plan in a long time, you may want to do that first.

If you have an existing business, you’ll also want updated information on your annual revenue, number of employees, your Employer Identification Number (EIN), and other basic data.

Then, nail down your pitch, and set aside time to answer all the specific questions on each grant application.

Applying for small business loans

The process for applying for a business loan depends heavily on which type of loan you’re pursuing.

If you’re going for a federal small business loan like a 7a loan, that will entail a very different process than going through a bank. Usually, there are more hoops to jump through for government financing, and navigating the maze online can be frustrating. But, federal loans can be easier to qualify for, so it may be a good alternative to a bank loan.

As you saw earlier, there are quite a few variations of small business loans, and the Fundera site lists specific banks and entities that offer each type.

And, there are services like Wayflyer, which conducts all its business online and specializes in eCommerce loans.

Before applying for small business loans, you want to know:

- Your credit score

- Why you need the loan

- Your average monthly revenue

- The amount you’re seeking

- Your plan for paying it back

Places to find small business grants and loans

Get ready, because there’s a deluge of resources for this. They vary in ease of use and navigation.

- Nav small business grant contest. Nav awards a $10,000 grant for small businesses every quarter, plus a runner-up grant prize, to any business types that apply and win their contest. This grant has almost no limitations.

- FedEx grant contest. FedEx runs their contest multiple times per year, and the winners also receive a print services credit, a website audit, and other perks. The top prize is $50,000.

- Visa global innovation grant. Visa’s grant contest comes with a few more stipulations than the first two, but they choose four winners every year.

- Grantwatch and Opengrants. These are fee-based grant-finding services that are great places to look for the smaller, niche-based grants that would otherwise be very hard to find. You can search by location, type of grant, business type, and other parameters.

- US Chamber of Commerce grants. This is another great source with all kinds of grants. And it includes a nice list of general small business grants that are available to most types of companies, in addition to ones with narrower qualifications.

- Self-employed business grants. If you’re self-employed and are a member of NASE, you may be able to apply for a small business grant every month, for up to $4000.

And there are other lists of grants from Nav, Bench, and the federal government. Government grants have a lower probability of qualification, because they tend to fund only very particular types of businesses.

What about the Small Business Association?

The SBA is a federal agency, and with a name like that, you would think they would offer grants to… small businesses. But most of their money funds state and local programs for small businesses.

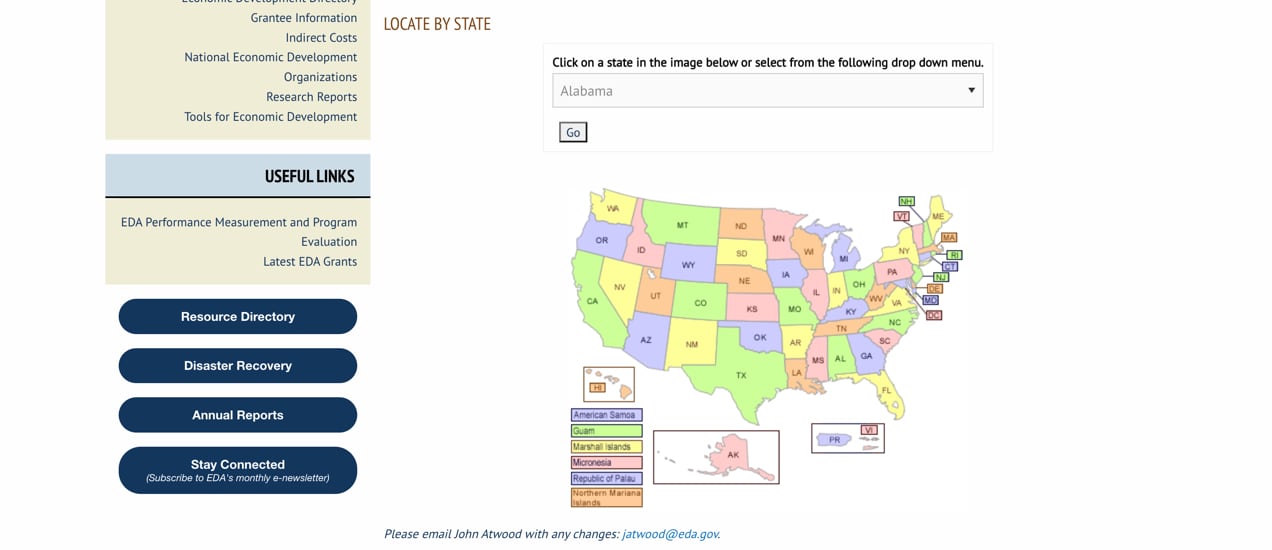

So for government grants, you may have better luck looking at the state and local level. The Economic Development Directory page won’t lead you to grants directly, but it does have a searchable and clickable map, by state, that will connect you with a number of local resources.

Small business loan resources

The federal small business loan program includes several choices that won’t be useful to most businesses. But the 7a program is the most common one, and that one is worth looking into if you want small business financing.

And as mentioned already, you can use Fundera for a huge variety of bank and institutional loans, mostly of the debt-based variety, and Wayflyer if you want a revenue-based loan for eCommerce businesses. Additionally, you may receive an offer automatically from WooCommerce if your business qualifies for a WooCommerce + Stripe Capital loan.

Go get ‘em!

If you’re looking for a way to give your new or existing business a financial boost, hopefully you’re now feeling a bit more inspired, motivated, and informed.

Here’s your plan of action:

- Update your business plan.

- Explore the resources that seem to fit your business and situation.

- Find the small business grants and financing options that you have a chance at winning.

- Talk to trusted advisors and mentors if you have them.

- Start filling out applications or act on an offer from WooCommerce + Stripe Capital today!

Note that with WooCommerce + Stripe Capital, all loans are issued by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC. All loans subject to credit approval.