Your ecommerce store’s success relies on many factors, and profit margin is one of them.

When you understand how your profit margin impacts your business, you can optimize for long-term sustainability. It’s not just about increasing sales volume — it’s about making each sale count.

But surprisingly, not all profits can help you reach your business goals. While some profits help you cover R&D or operational expenses, others contribute to your business’s expansion in different markets or product segments. That’s why you need to know which profit margin type to optimize.

With these distinctions in mind, let’s explain what profit margin is, why it matters, and how you can improve it to build resilience in your business.

Profit margin refers to the percentage of your business’s income that’s left over after deducting all of your costs. If you generated $20,000 in revenue this month and your overall costs are $13,500, you’ve made a profit of $6,500.

Usually, the profitability of a business is calculated as the percentage of profit earned on each dollar of sales. Divide your profit by your overall sales and then multiply that by 100 to get your profit margin.

Example:

Profit margin = 6500/20000 x 100 = 32.5%

For every dollar of sales, you’re making 32.5 cents in profit.

Progress toward your business goals can’t usually be measured by overall profit margin alone.

Here are the three types of profit margins you need to use along with their respective profit margin formulas:

Gross profit margin

Gross profit margin measures a company’s profit after deducting the costs directly associated with producing its products or services, known as Cost of Goods Sold (COGS).

Here’s how you can calculate gross profit margin:

Gross profit margin = [(Revenue – COGS) / Revenue] x 100

Let’s say an ecommerce store sells a product for $100 and it costs them $60 to produce this product.

Revenue = $100

COGS = $60

Gross Profit Margin = ($100 – $60) / $100 x 100 = 40%

For every dollar of sales, the company keeps 40 cents as gross profit.

Operating profit margin

Operating profit margin accounts for all operating expenses, including COGS and other costs like rent, utilities, and payroll.

Here’s how you calculate operating profit margin:

Operating Profit Margin = [(Revenue – COGS – Operating Expenses) / Revenue] x 100

Using the same example above:

Revenue = $100

COGS = $60

Operating Expenses (e.g. website hosting, customer service, marketing) = $20

Operating Profit Margin = ($100 – $60 – $20) / $100 x 100 = 20%

This indicates that after accounting for COGS and operating costs, the company keeps 20 cents of every dollar in sales as an operating margin.

Net profit margin

Net profit margin is the most comprehensive profitability metric. It accounts for all costs — including taxes and interest payments.

Here’s the net profit margin formula:

Net Profit Margin = [(Revenue – Total Expenses) / Revenue] x 100

Using the same example above:

Revenue = $100

Total Expenses (COGS + Operating Expenses + Taxes + Interest) = $85

Net Profit Margin = ($100 – $85) / $100 x 100 = 15%

For every dollar the company makes, it keeps 15 cents of every dollar in sales as net profit margins.

It’s easy to confuse gross and net profit margins because of how similar they may seem. But there are several differences between the two metrics.

Gross profit margins don’t account for operating expenses, taxes, or interest payments. Net profit does, and thus is referred to as the actual bottom line.

So, gross profit margin lets you understand the core profitability of your products or services without looking at what you’ve spent to make those sales. And net profit shows you the actual profit, so you can distribute it to owners or reinvest in the business.

Also, gross profit shows the direct correlation between production costs and revenue. Suppose you have a high gross profit margin (over 50%). This tells you that you’re efficiently delivering the product or service you’re selling.

But net profit shows you the complete picture. According to New York University’s benchmark reports, 42.78% is retail’s average net profit benchmark. If you make more than this, you’re very good at managing all of your costs — and are financially stable.

Note: If your gross profit is very high compared to your net profit, tightening operating efficiency should be your next area of focus.

While profit margin lets you measure your overall business health, it also impacts how you optimize different facets of your business.

Here are a few ways it can impact your strategy:

1. You can optimize pricing

When deciding how much to charge for your product or service, you need to balance attracting customers with maintaining the company’s profitability. That’s why knowing your margins is a must. It helps you:

- Set minimum prices: Knowing a product’s lowest possible selling price that still allows for profit helps you stay competitive while taking care of your business.

- Try dynamic pricing models: With numbers in hand, you can adjust prices based on demand or competition without compromising your business’s profitability.

- Offer strategic discounts: Use your financial data to provide discounts on high-margin products to maintain profitability during sales.

Let’s say you’re selling smartphone cases and know your luxury cases have a 60% margin instead of 25% on plastic cases. You can afford a steeper discount on the luxury cases and turn a profit irrespective of the discount.

2. You can pinpoint the most profitable products

Not every product you sell will turn a massive profit, but that’s not necessarily a reason to shelve them. Instead, come up with a strategy to focus your marketing and advertising efforts on the most profitable items.

Let’s say you’re running a bookstore, and fantasy novels have a healthy profit margin of 65% as opposed to a 20% margin on romance novels. In this scenario, you’d market the fantasy novels more. You could also use this information to negotiate better deals with your authors or suppliers and increase profits.

Knowing your profit margin also helps to inform which products to stock up on and which ones to invest in research and development (R&D).

3. You can analyze your largest expenses

Looking into your gross and operating margins tells you exactly which expenses (sales expenses? Marketing? Manufacturing?) impact your profits. As a result, you can optimize your logistic operations upstream (e.g., supplier negotiations) or downstream (e.g., automations).

Here’s a scenario: Your apparel store’s shipping costs disproportionately affect your operating profit margin. In this case, you could either:

- Change your free shipping policy: Instead of a site-wide offer, provide free shipping only on certain products or orders above a specific value.

- Bundle products and increase average order sizes: Redirect customers to bundled offers or only sell certain products in multiples.

- Negotiate better rates with your delivery partners: While it’s hard to negotiate shipping rates, it can be easier than tinkering with a site and sales strategy that’s already proven.

Each strategy significantly reduces your shipping costs — while increasing your margins.

4. You can improve your business’s financial health

Each profit margin calculation provides a few of your business performance. These metrics are key indicators of long-term viability and show whether it’s practical to reinvest in the business or expand over time.

If your business generates a total revenue of $500,000 yearly with a 10% profit margin, you only have a $50,000 leeway to reinvest in marketing, product development, or expansion. If there’s an economic downturn, this thin margin may not be enough to allow you to pivot or absorb the slow season. So, you should optimize your business processes to improve margins and stay competitive.

Now that you know why it’s important to track and increase profit margins, along with how to calculate profit margin, let’s look at some tips for improvement.

1. Increase average order value

Average order value (AOV) refers to the average amount your customers spend per order. The higher the spend, the higher your AOV will be.

That said, it’s an excellent way to increase your margins, as a higher AOV also means the fixed costs associated with each transaction are spread over a more extensive revenue base. You can do this by offering an upsize or upsell during checkout.

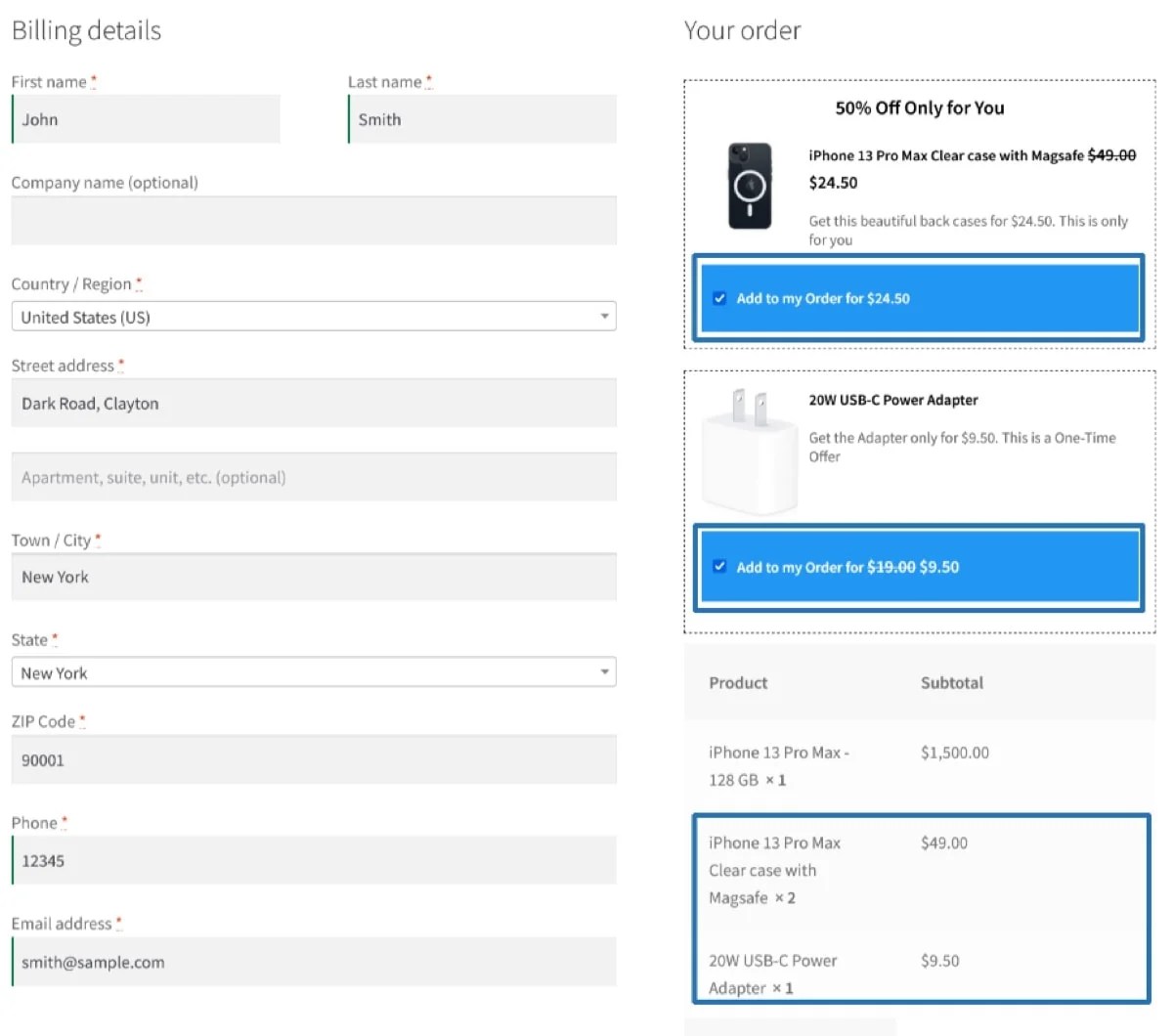

Extensions like OrderBump let you do this automatically based on the type of product, the customer’s purchase history, or the purchase period. In the example below, when a customer buys an iPhone, the extension pulls out relevant upsells like a phone case and a USB C-type power adapter that they might need. Plus, it offers it at a discounted rate, enticing customers to add it to their cart.

You could also increase AOV using strategies like:

- Offer a free shipping threshold: Requiring minimum spend to earn free shipping prompts customers to add more items to their cart.

- Create product bundles: Sell groups of similar products at discounted rates to save on shipping and processing costs.

- Offer volume-based discounts: Create discounts like “Buy two, get 10% off” to encourage bulk orders.

- Enable buy now, pay later (BNPL) at checkout. Provide access to deferred payment opportunities to increase consumer confidence when making larger purchases.

2. Upsell or cross-sell to existing customers

If you’re selling more or a premium version of the same product, it’s an upsell. And if you’re encouraging the customer to buy a different product, that’s a cross-sell. The main idea is to increase profit margins through existing customers.

In a study by First Page Sage, their client’s average customer acquisition cost (CAC) during the period measured was $64 for organic channels and $68 for paid channels. Costs may differ across businesses and niches, but the point stands: It’s expensive to acquire new customers.

As a result, it’s often much easier to focus on making more money from existing customers and increasing their customer lifetime value (LTV).

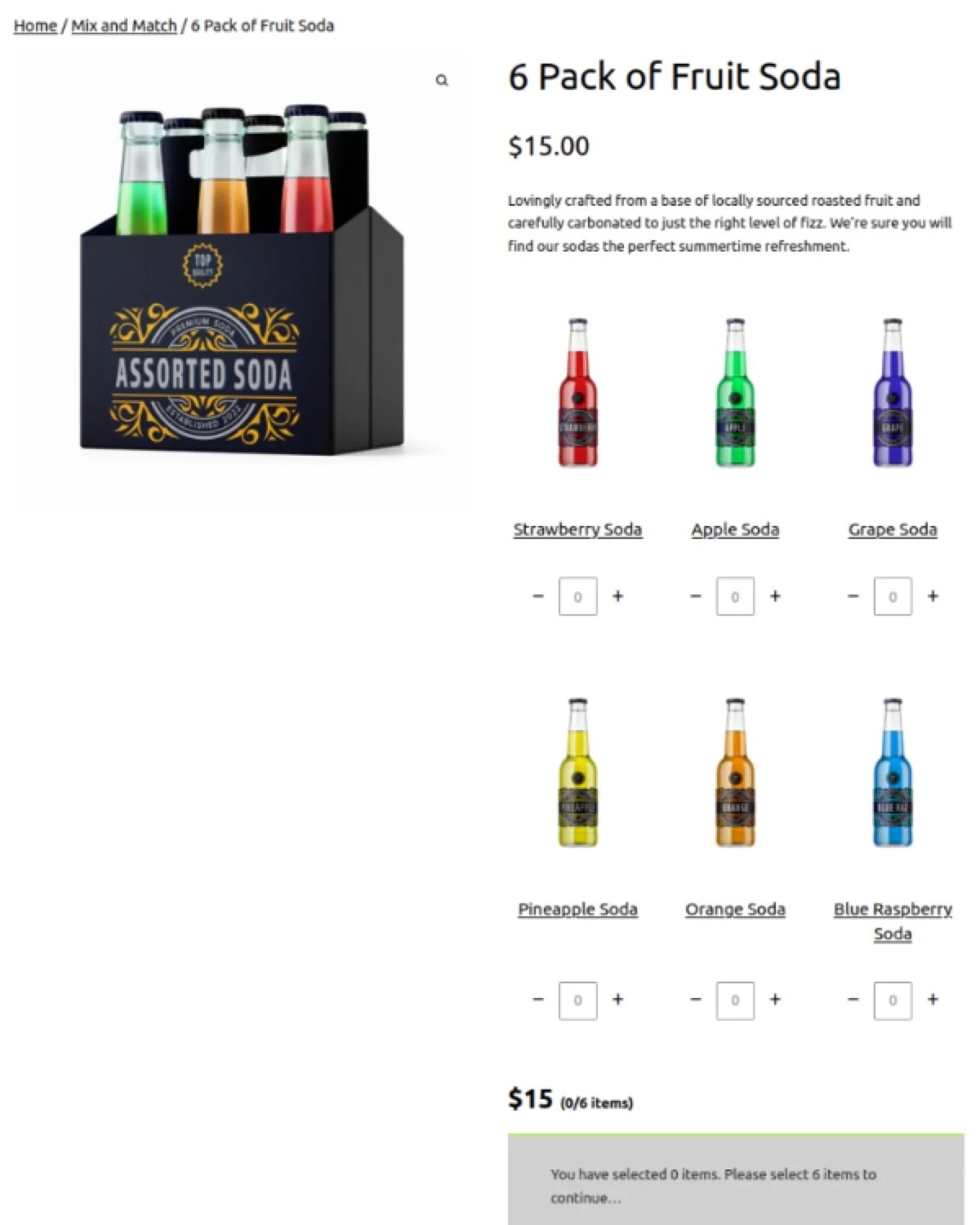

Extensions like Mix and Match Products let you put the choice in the hands of your customers. Let’s say they want to buy a few bottles of fruit soda. They might feel restricted if you offer bundled options for the same flavor or pre-built bundles of different flavors. Instead, let them choose the flavors and specify the quantity.

Alternatively, look at your customer’s purchase history and offer personalized recommendations. You can add these categories yourself, offer choices on the product page, or use extensions that rely on algorithms to sort these automatically. That’s what the August Apparel website does, letting shoppers add on optional embossed initials, shoe trees, or insoles.

Remember: you want to improve the customer’s experience — not push unwanted items, so make sure you offer the right products at the right time.

3. Improve shipping and logistics

Customers love free things — and free shipping is no different. A recent PYMNTS survey found that 66% of consumers demand free shipping. If they don’t get it, they won’t follow through with the purchase. But it’s also a significant expense to your business and impacts your margins even if you charge customers for it. So, how do you address it?

For starters, offer a minimum order value for free shipping.

Alternatively, experiment with flat rate shipping or live rate shipping costs. The former lets you charge a fixed rate based on parameters like box size, product types, or number of boxes. In the latter, you can use an extension like FedEx Shipping Method to calculate live rates based on the delivery timeline, flight type, and region. These shipping strategies make it less likely that customers will be surprised by the final amount due, leading to fewer abandoned carts.

4. Improve advertising efforts

Focus on channels that bring you the best return on ad spend (ROAS). If you’ve found better luck with Google Ads than Facebook Ads, then stick to Google Ads.

Your goal is to create highly targeted campaigns that reach relevant audiences on the right channels. Use existing customer data to see which audience segments are the most profitable and which product lines generate the most sales revenue. You can then redirect ad spend towards these groups to reduce waste.

Google for WooCommerce uses artificial intelligence (AI) to create product ads directly from your catalog. But the standout feature here is that it uses real-time signals to show the right products to users at the right time. You get more for your money and don’t have to continuously monitor and refine your listings.

5. Establish customer loyalty

Every sale you make is an opportunity to build affinity with your customers. If you want to turn your customers into raving fans, developing a loyalty program can get you closer to that goal. Base the program on a points and rewards system that lets customers collect and use those points for future purchases. Or you could offer tiered benefits like unlocking new perks after being a loyal customer for a specific period or reaching higher spending thresholds.

Use the Points and Rewards extension to set up these systems. So, for every action a customer takes, there’s a potential benefit for them.

One significant survey found that several factors impact customer loyalty, like:

- Excellent customer service

- The quality of the product/service

- Product availability

- Product options

- Data privacy policies

So, taking a closer look at your customer journey and company policies can help you build brand loyalty over time. Customers tend to return to brands that prioritize exceptional customer experiences — which means you increase your LTV and your profit margins with every customer you acquire.

In addition, be sure to dedicate a portion of your marketing resources to retaining customers (instead of only focusing on finding new ones). Offer valuable resources to help them use and stick to your product. It keeps your brand top of mind and establishes a stronger relationship.

The Jetpack CRM extension uses customer data to segment communications based on demographics, purchase history, or behavior. You also get access to powerful sales and customer service tools, like detailed customer profiles with transaction and interaction history.

6. Reduce product returns

Returns are a big profit drain for ecommerce businesses because of:

- Return shipping and logistics costs

- Potential product damage

- The need for restocking

According to Statista, 14.5% of retail purchases end in a return. That means you can expect one of every seven orders to be returned. If you can reduce this number for your store, it can go a long way.

Here are a few reasons why customers return products:

- They purchased the wrong item

- They don’t need the product anymore

- They want to replace it

- You shipped the wrong item

- They received a defective product

Most of these issues can be solved by offering in-depth product information. Create detailed product descriptions, measurements, and care instructions. If an item runs small or large, mention this in the product description. If a product requires assembly or specific care requirements, clarify this before purchase.

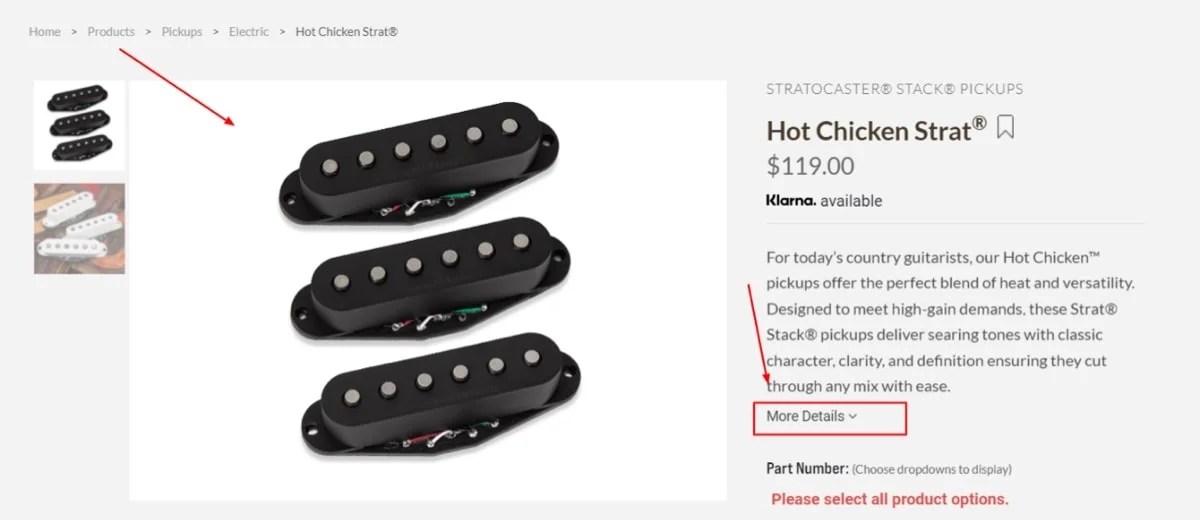

Also, include high-quality images and videos so that customers can see the product’s true form before buying it. Here’s an example from Seymour Duncan:

In this example, you can see detailed product images and full product details and specs.

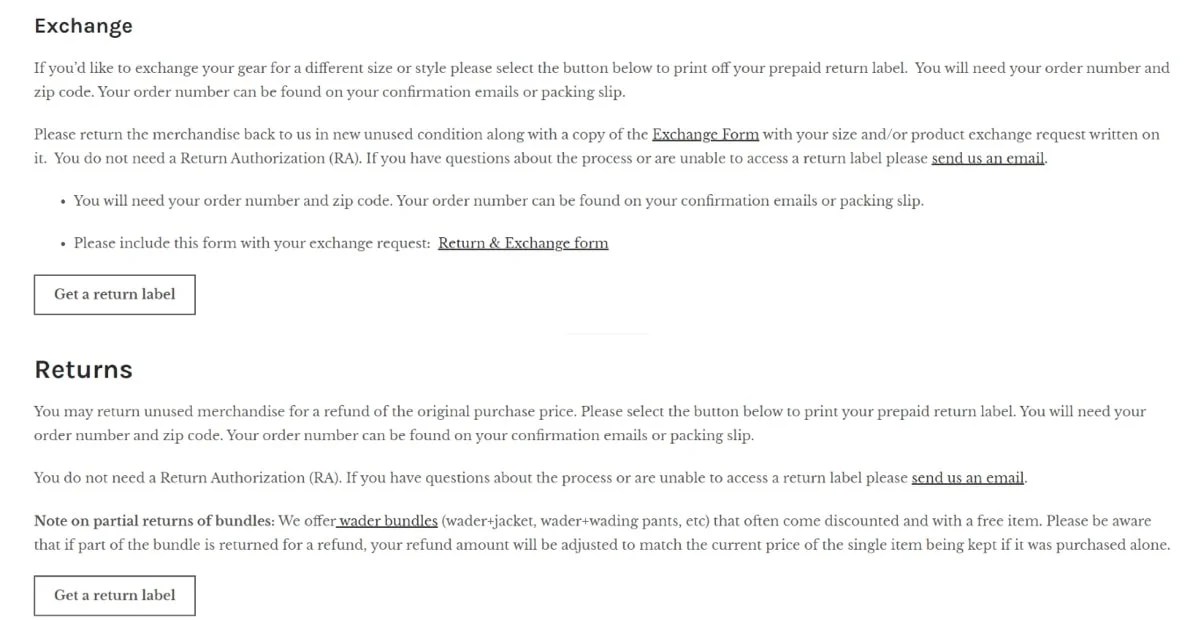

Analyze your returns data to identify patterns, too. Are certain products returned more frequently? Is there a common reason given for returns? Use this data to improve your products or provide more information in your return policy, like in this policy from Dryft Fishing.

7. Analyze your product lines

You need to have the right mix of products to improve profitability. Start by conducting a thorough analysis of your entire product range. Look at the metrics for each item, including things like:

- Gross margin

- Sales volume

- Inventory turnover

- Net margin

- Return rates

- Customer ratings

This will help you identify your shop’s most and least profitable items. Access this data using extensions like Sales Analysis for WooCommerce and build your own reports. You can filter charts based on product lines, regions, sales volume, and revenue.

Look for opportunities to expand successful product lines, too. If a particular product is selling well, offer variants or complementary products.

Use frameworks like the BCG matrix, also known as the growth-share matrix, to categorize your products:

- Stars (high growth, high market share): Prioritize them in your marketing/advertising efforts.

- Cash cows (low growth, high market share): Maintain their position but minimize further investment.

- Question marks (high growth, low market share): If they can be turned into stars, experiment with them or else eliminate them.

- Dogs (low growth, low market share): Eliminate them from your portfolio to focus on the other three categories.

You could use a similar framework to categorize your portfolio based on high-volume, low-margin, low-volume, and high-margin products. The idea is to keep an eye on which products drive the most growth and profit margins for your business.

8. Boost your store’s performance

Improving your store’s performance impacts your profit margins, influencing conversion rates and user experience. A Portent study found that a site that loads in a second has a conversion rate 2.5 times higher than one that loads in five seconds.

The reason? Customers are less likely to become frustrated while shopping and give up on finding what they need. So, your goal is to make the experience seamless, starting with your website’s performance.

Here are a few ways you can improve your store’s performance:

- Use a lightweight WordPress theme: The WordPress default theme, Twenty Twenty-Five is always a good option.

- Choose a reliable hosting provider: Look for one with a good track record with WordPress sites, like WordPress.com, Pressable, or WordPress VIP.

- Implement lazy loading: This setting loads images and videos only when a visitor scrolls to their place on a page.

- Remove unnecessary plugins: These could be weighing down your site and are also a security risk.

- Integrate speedy site search functionality: Jetpack Search, for example, helps customers find products faster, with filters, visual search options, and spelling correction.

- Use a content delivery network (CDN). This loads your site from a server that’s closest to each customer.

- Compress images on your website: Images are often the weightiest element of a site, and compressing them, using a tool like Jetpack Boost, can result in significant improvements.

- Optimize your website for mobile devices: After all, 77% of traffic and 66% of orders come from these devices.

- Look for friction points: Review your site’s navigation and checkout process to add clarity and resolve bumps where necessary.

Profit margins are a primary indicator of your business’s health — so it’s not a one-time task. Instead, implement these strategies to continuously monitor your store’s profitability and optimize it for growth. That’s the key to building a resilient ecommerce business that thrives over the long run.

To do this well, you need to have the right tools on hand. If you run your store on WooCommerce, the best place to start is with the extension library. There, you’ll find tons of options to help with essential drivers of a good profit margin — everything from marketing optimization to merchandising and store management.

If you’re ready to improve profit margins, start with WooCommerce and its extension marketplace. Your boosted sales and profits will thank you.

Kathryn Marr is the co-founder and Chief Creative Officer of Blue Ivory Creative, where she combines design expertise with a deep understanding of ecommerce and WordPress. She helps brands turn complex ideas into clear, compelling content that connects with their audience — whether they’re just starting out or firmly positioned among the world’s leading companies.